Vat On Second Hand Goods From Abroad . import vat is a fee currently paid on goods sent to the uk from abroad, but instead of the normal vat you would pay at the checkout for your items, you’ll pay ‘import. unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. And what amounts to ‘a business’ for vat.

from tallysolutions.com

before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: import vat is a fee currently paid on goods sent to the uk from abroad, but instead of the normal vat you would pay at the checkout for your items, you’ll pay ‘import. unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. And what amounts to ‘a business’ for vat. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to.

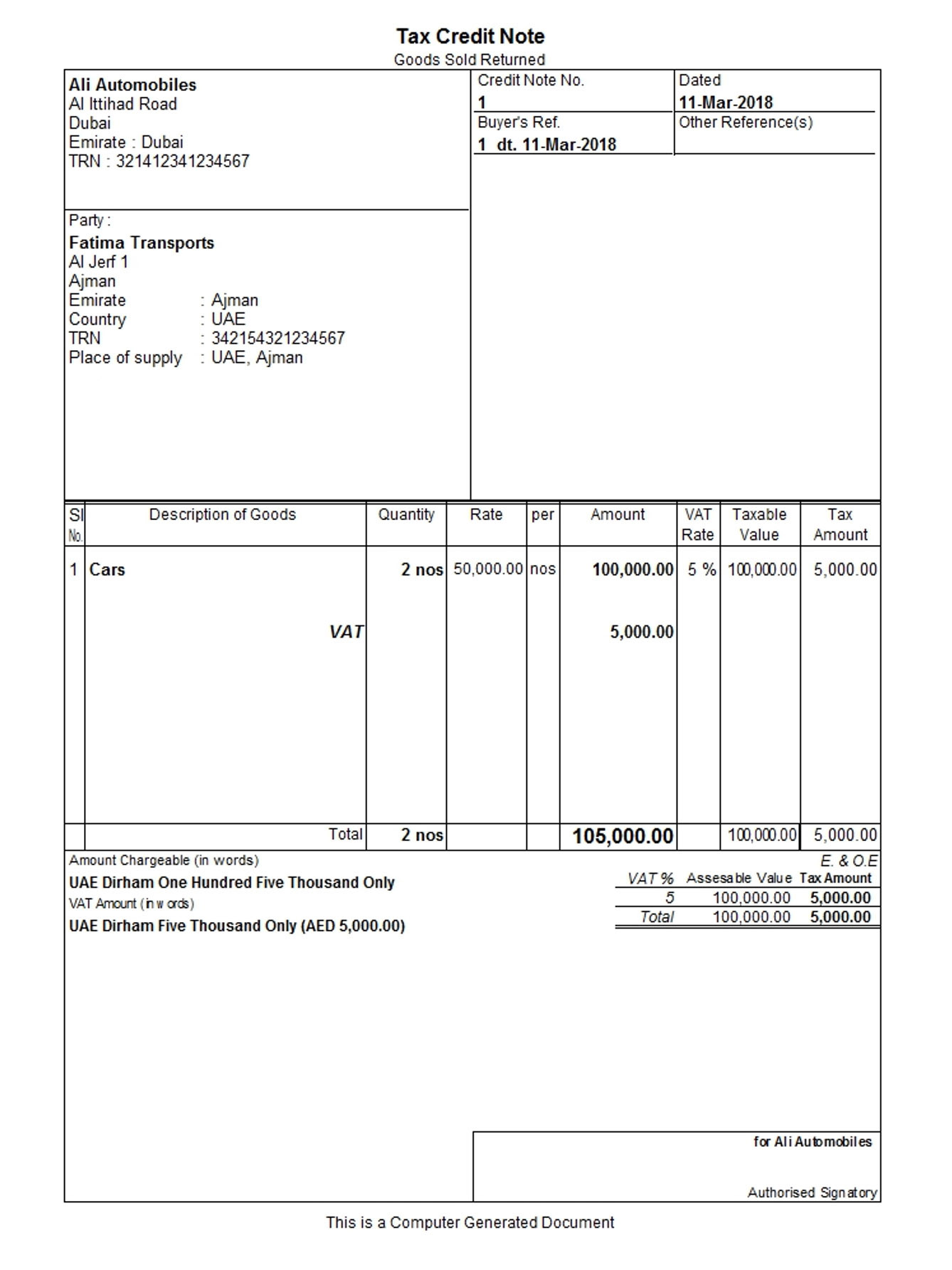

How to Issue a Credit Note for Return of Goods under VAT in UAE

Vat On Second Hand Goods From Abroad import vat is a fee currently paid on goods sent to the uk from abroad, but instead of the normal vat you would pay at the checkout for your items, you’ll pay ‘import. And what amounts to ‘a business’ for vat. import vat is a fee currently paid on goods sent to the uk from abroad, but instead of the normal vat you would pay at the checkout for your items, you’ll pay ‘import. whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to:

From ukcarhub.com

Is There VAT on Second Hand Cars? 2024 Innovative Vat On Second Hand Goods From Abroad before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: And what amounts to ‘a business’ for vat. whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. unfortunately, following brexit, vat. Vat On Second Hand Goods From Abroad.

From accountsco.it

New VAT rules for overseas sellers AccountsCo Vat On Second Hand Goods From Abroad And what amounts to ‘a business’ for vat. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: unfortunately, following brexit, vat will. Vat On Second Hand Goods From Abroad.

From www.change.org

Petition · Abolish the 20 VAT on imported 2nd hand goods into the UK Vat On Second Hand Goods From Abroad unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. import vat is a fee currently paid on goods. Vat On Second Hand Goods From Abroad.

From www.refurbishedportablecabins.co.uk

20FT Used Wind & Watertight Container Ref Container258 Price £2,200 Vat On Second Hand Goods From Abroad before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. And what amounts to ‘a business’ for vat. whether you are importing goods. Vat On Second Hand Goods From Abroad.

From www.dscca.com

VAT Secondhand cars using the Margin Scheme DSC Chartered Vat On Second Hand Goods From Abroad import vat is a fee currently paid on goods sent to the uk from abroad, but instead of the normal vat you would pay at the checkout for your items, you’ll pay ‘import. whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required.. Vat On Second Hand Goods From Abroad.

From www.youtube.com

May 2017 Video 5 VAT on second hand goods nature of silver coins Vat On Second Hand Goods From Abroad before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. check if you need to pay import vat when you import goods. Vat On Second Hand Goods From Abroad.

From kpmg.com

VAT Matters Promo items & secondhand cars KPMG Ireland Vat On Second Hand Goods From Abroad unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. before receiving your goods, you may have to pay. Vat On Second Hand Goods From Abroad.

From cruseburke.co.uk

How Much is VAT in the UK Complete Guideline CruseBurke Vat On Second Hand Goods From Abroad unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. import vat is a fee currently paid on goods sent. Vat On Second Hand Goods From Abroad.

From sme.tax

VAT Archives SME.TAX Vat On Second Hand Goods From Abroad And what amounts to ‘a business’ for vat. whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. . Vat On Second Hand Goods From Abroad.

From www.linkedin.com

VAT Second Hand Goods Scheme what is it and when can it be used for Vat On Second Hand Goods From Abroad unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. And what amounts to ‘a business’ for vat. import vat. Vat On Second Hand Goods From Abroad.

From www.studocu.com

VAT summary taxable supplies VAT TAXABLE SUPPLIES VAT is levied on Vat On Second Hand Goods From Abroad And what amounts to ‘a business’ for vat. unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. check. Vat On Second Hand Goods From Abroad.

From www.taxaccountant.co.uk

VAT Margin Schemes SecondHand Goods Vat On Second Hand Goods From Abroad whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. And what amounts to ‘a business’ for vat. . Vat On Second Hand Goods From Abroad.

From www.scribd.com

VAT 264 Declaration For The Supply of Second Hand Goods External Form Vat On Second Hand Goods From Abroad before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. check if you need to pay import vat when you import goods into great. Vat On Second Hand Goods From Abroad.

From secondhandtruckszenhei.blogspot.com

Second Hand Trucks Vat On Second Hand Trucks Vat On Second Hand Goods From Abroad unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: import vat is a fee currently paid on goods sent to the uk from. Vat On Second Hand Goods From Abroad.

From www.youtube.com

UAE VAT Treatment 12 Others Export Second hand goods any supply or Vat On Second Hand Goods From Abroad unfortunately, following brexit, vat will need to be paid on goods from the eu at import into the uk at the standard rate. check if you need to pay import vat when you import goods into great britain from outside the uk, or outside the eu to. And what amounts to ‘a business’ for vat. whether you. Vat On Second Hand Goods From Abroad.

From ukcarhub.com

Is There VAT on Second Hand Cars? 2024 Innovative Vat On Second Hand Goods From Abroad before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. import vat is a fee currently paid on goods sent to the. Vat On Second Hand Goods From Abroad.

From tallysolutions.com

How to Issue a Credit Note for Return of Goods under VAT in UAE Vat On Second Hand Goods From Abroad whether you are importing goods from the eu to the uk for your business, or purchasing an item for personal use, you will be required. import vat is a fee currently paid on goods sent to the uk from abroad, but instead of the normal vat you would pay at the checkout for your items, you’ll pay ‘import.. Vat On Second Hand Goods From Abroad.

From goselfemployed.co

VAT Margin Scheme for SecondHand Goods Vat On Second Hand Goods From Abroad before receiving your goods, you may have to pay vat, customs duty or excise duty if they were sent to: import vat is a fee currently paid on goods sent to the uk from abroad, but instead of the normal vat you would pay at the checkout for your items, you’ll pay ‘import. check if you need. Vat On Second Hand Goods From Abroad.